Table of Contents

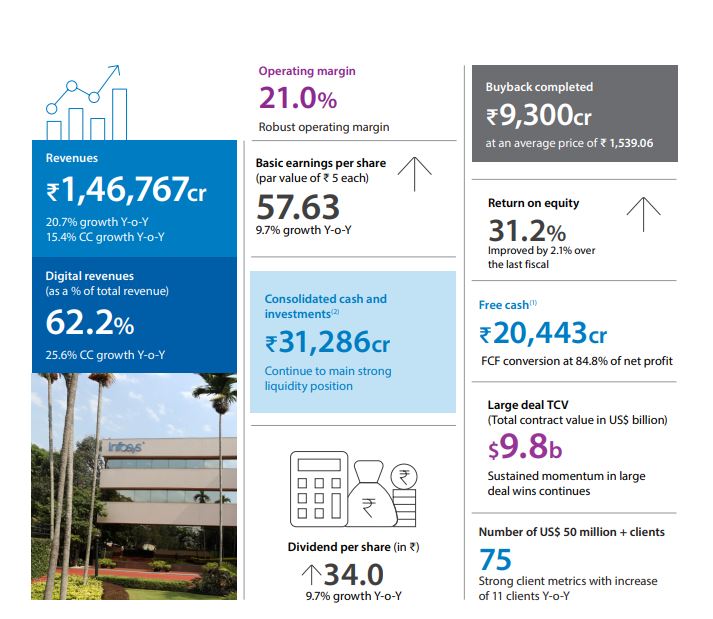

Infosys Overview:

Infosys is a global leader in next generation digital services and consulting. It enable clients in more than 56 countries to navigate their digital transformation. With over four decades of experience in managing the systems and workings of global enterprises, Infosys expertly steer clients, as they navigate their digital transformation powered by the cloud. It enables them with an AI-powered core, empower the business with agile digital at scale and drive continuous improvement with always-on learning through the transfer of digital skills, expertise, and ideas from its innovation ecosystem.

Established in 1981, from a capital of US$250, Infosys has grown to become a company with a market capitalization of approximately US$72.35 billion. In a journey of over 40 years, it has catalyzed India’s transformation into the global destination for software services talent. It pioneered the Global Delivery Model and became the first IT company from India to be listed on NASDAQ.

Infosys share Recent Performance:

Infosys has mostly remained side ways throughout the year and as visible it is forming a inverted head and shoulder pattern. It is also in news as it has lost a deal worth 1.5 billion dollars after its CFO has resigned.

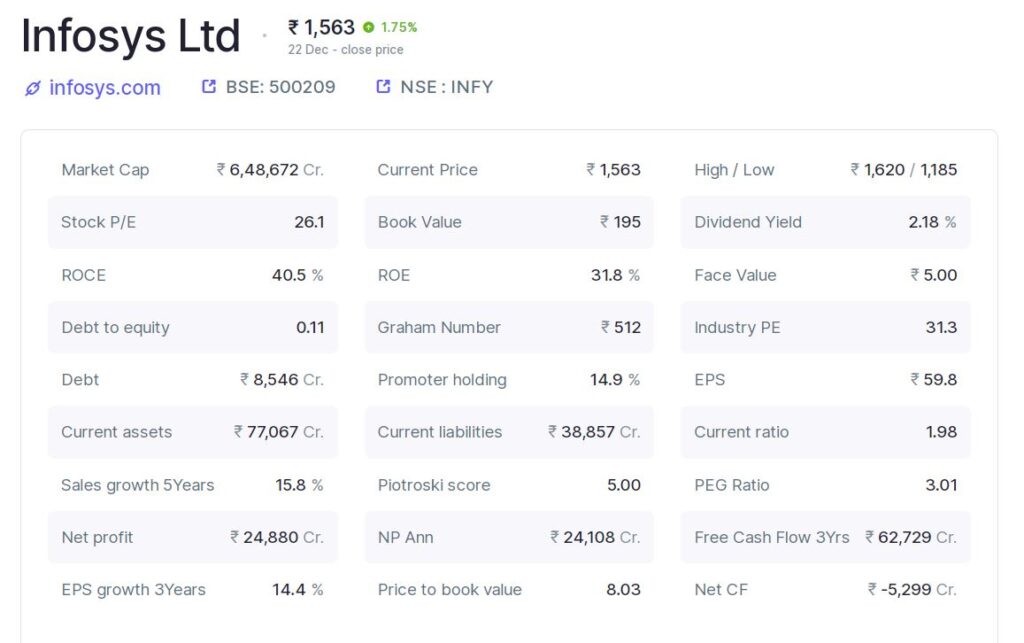

Fundamental Analysis of Infosys:

- The stock P/E is less than the industry P/E which is good. The Graham Number shows it is a overvalued share. But most of the big and good companies are generally overvalued.

- The ROCE and ROE are brilliant.

- The Net Cash Flow for this year is negative which is a red flag.

- The Free Cash flow is positive which means that the company has full liberty to utilize the profits.

- The Annual Net Profit is positive.

- The sales growth in the last 5 years has been decent.

- The Piotriski score is average.

- The PEG ratio is more than 1 which is a red flag.

- The EPS growth 3 years is decent.

- The company is almost Debt free as the Debt to Equity ratio is 0.11.

- The current ratio is also greater than 1 which is a good sign.

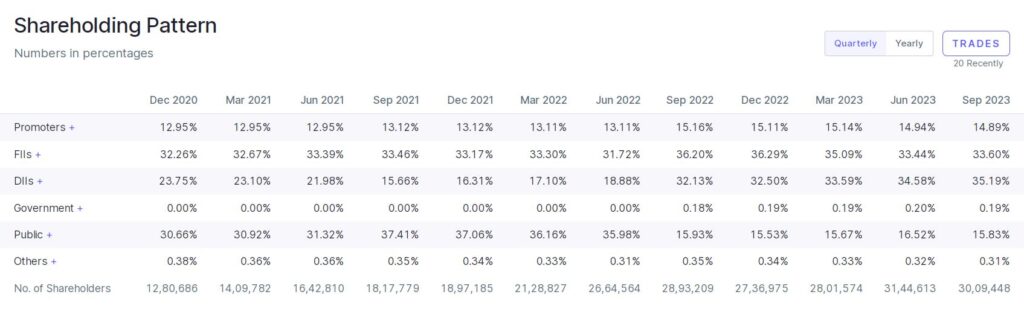

The shareholding pattern shows that the promoter holding has decreased in the past one year and the FII’s have reduced their stake in this company from the past one year but the DII’s have increased their stake significantly. The shareholding pattern is overall positive here.

Overall we can see the company is fundamentally strong and with most of the ratios looking decent barring a few but it is not a great company from returns point of view as it is already among the biggest company in the country. And bluechips are generally good from stability point of view.

Technical Analysis of Infosys share:

From the technical indicators we can see the following about Infosys share:

- The stock is in an uptrend on the daily chart as seen in the supertrend indicator.

- The RSI is near 66 showing the share price is approaching a overbought zone and we might see an upmove.

- The ADX indicator is showing that the trend is average of uptrend.

- MACD indicator is showing the price may go down as the strength of MACD has decreased.

- The 50 DEMA is above the 200 DEMA showing that share has been in a uptrend.

Conclusion:

We can see that the Infosys share has been in a up trend but the news of the CFO resigning and the deal worth over a billion. The company is fundamentally strong and we might see an up move further in the long run although it might not be very high. Bluechips are good for stability purpose but not for returns purpose as the chances of them giving many fold return is not possible. However, Please do your own research as this is not a buy or sell recommendation. It is just for information and analysis purpose.

For other stock related updates you can check our instagram page here.

For other fundamental analysis of Adani Enterprises Ltd. share you can click here.